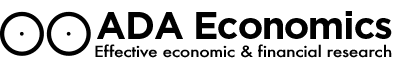

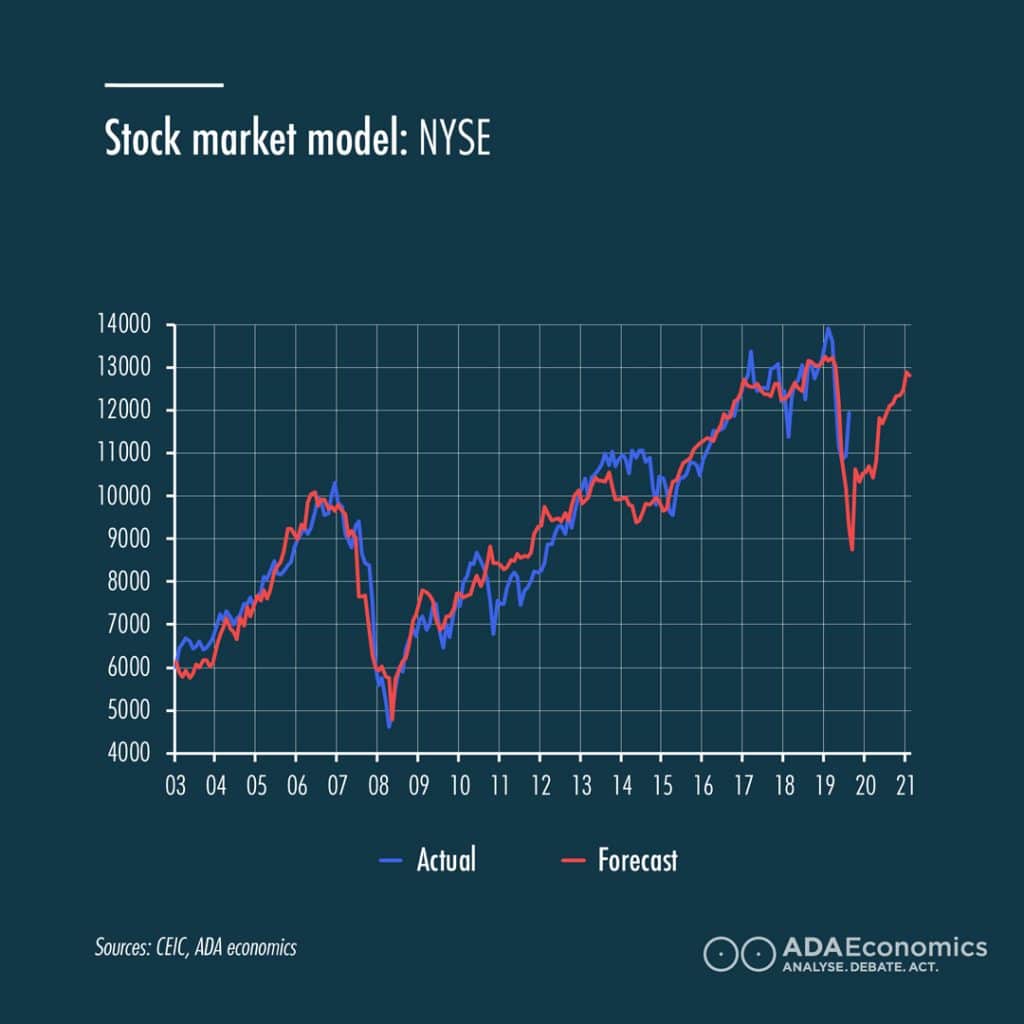

We have created stock market models to give an indication of equity valuations and trends that are compatible with our views of the world.

The message of our US model is that there is further upside to equity prices – the key reason is the unlimited support from the Fed.

The message of our German model is that the DAX is now is overvalued territory.

In our view, the German economy is likely to feel a lot less structural damage from the COVID-19 epidemic than other countries in Europe, but from a cyclical perspective some of its key industries will suffer from weaker global demand (in cars for example) and German individuals and businesses have much less appetite for debt than other countries (such as the US or France for example), as a result QE has a lower impact on equity prices than elsewhere.