The FOMC kept the target range for the federal funds rate unchanged at 1.5-1.75%, as widely anticipated, yesterday (11 December) and signalled a rather comfortable hold position in the coming months, given that the economy is showing signs of improvement, even though the recovery overall remains moderate.

The improvement in the economy is not a surprise for us. We have been flagging that the global business cycle had started to stabilise, since late last spring, which it did. We also believe that the consensus expectations for 2020E US real GDP growth next year is a good half a percentage point too low.

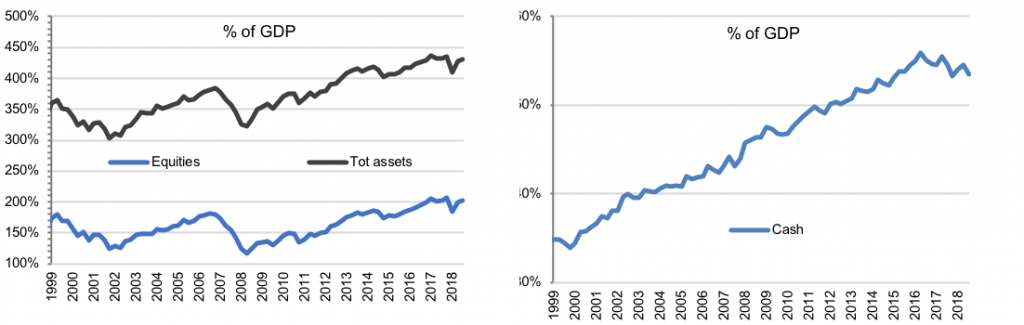

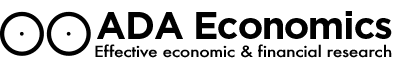

That said, this is not enough to call the end of the monetary easing phase. Those that think the central banks are done are grossly underestimating two important details. First, we are in a peculiar historical phase: central banks artificially extended the business cycle and successfully avoided a recession, for now. But this is not a stable equilibrium. A recession can be delayed for a few years, but not permanently. To do so, the US economy (just like the Eurozone) needs ever more monetary stimulus. Secondly, the debt level of US non-financial corporations is high – 30% of GDP more than in 2007 – and households’ balance sheets show higher exposure to equities than in 2007, with falling cash buffers relative to GDP in the past three years.

The recent pick-up in bond yields is a transitory phase, 2020E will see historically low treasury yields, in our view. Central bankers have signalled an exceptionally high aversion to letting a recession take place. This artificial extension of the business cycle, in our view, could last up to 2022E. When it ends – with a bang – it will herald a profound reshaping of monetary, fiscal and industrial policies.

US households: total financial assets as a percentage of GDP are high, but with equity holdings that exceed the 2008 peak, while cash levels have fallen as a percentage of GDP60